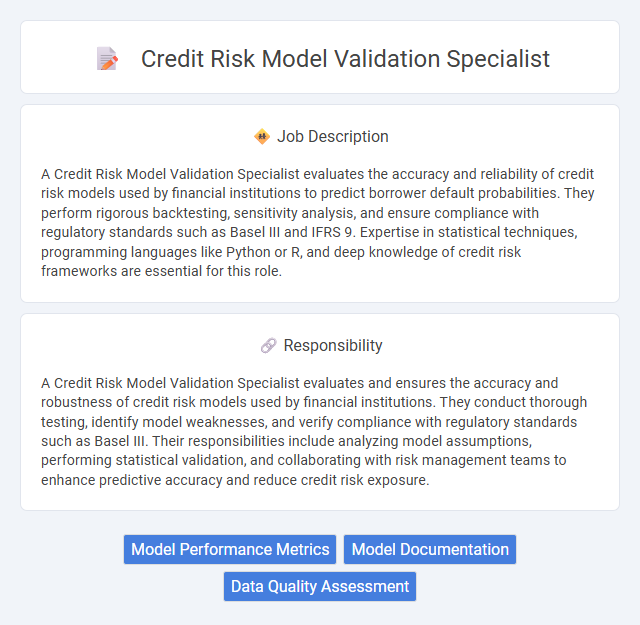

A Credit Risk Model Validation Specialist evaluates the accuracy and reliability of credit risk models used by financial institutions to predict borrower default probabilities. They perform rigorous backtesting, sensitivity analysis, and ensure compliance with regulatory standards such as Basel III and IFRS 9. Expertise in statistical techniques, programming languages like Python or R, and deep knowledge of credit risk frameworks are essential for this role.

Individuals with strong analytical skills and attention to detail are likely suited for a Credit Risk Model Validation Specialist role. Those comfortable with complex financial data and regulatory compliance may find this position aligns well with their capabilities. Candidates lacking expertise in risk assessment or model validation could face challenges adapting to the job requirements.

Qualification

A Credit Risk Model Validation Specialist must possess strong quantitative skills, typically demonstrated by a degree in statistics, finance, economics, or a related field, and proficiency in statistical software such as SAS, R, or Python. Expertise in credit risk modeling techniques, regulatory frameworks like Basel III, and experience with model governance and validation processes are essential. Strong analytical ability, attention to detail, and effective communication skills are crucial for interpreting model performance and ensuring compliance with regulatory standards.

Responsibility

A Credit Risk Model Validation Specialist evaluates and ensures the accuracy and robustness of credit risk models used by financial institutions. They conduct thorough testing, identify model weaknesses, and verify compliance with regulatory standards such as Basel III. Their responsibilities include analyzing model assumptions, performing statistical validation, and collaborating with risk management teams to enhance predictive accuracy and reduce credit risk exposure.

Benefit

The role of a Credit Risk Model Validation Specialist likely offers significant benefits, including enhanced expertise in identifying and mitigating credit risks through rigorous model assessment. Professionals in this position probably experience improved decision-making skills and the opportunity to contribute to financial stability and regulatory compliance. Career growth in risk management and competitive compensation are also potential advantages tied to this specialized role.

Challenge

A Credit Risk Model Validation Specialist likely faces the challenge of accurately assessing complex financial models under uncertain market conditions, requiring a deep understanding of both quantitative methods and regulatory standards. Ensuring the models' robustness and reliability may involve identifying subtle errors or assumptions that could significantly impact credit risk predictions. The role probably demands balancing technical scrutiny with practical risk management to support informed decision-making within the organization.

Career Advancement

Credit Risk Model Validation Specialists play a crucial role in ensuring the accuracy and reliability of financial risk models, directly impacting regulatory compliance and strategic decision-making. Mastery of statistical techniques, regulatory frameworks such as Basel III, and hands-on experience with model validation tools enables professionals to advance into senior risk management or data science roles. Continuous development through certifications like CFA or FRM and exposure to machine learning applications in risk assessment significantly enhances career growth prospects.

Key Terms

Model Performance Metrics

Credit Risk Model Validation Specialists assess model performance metrics such as Accuracy, ROC-AUC, Gini coefficient, and KS statistic to ensure predictive reliability in credit risk forecasting. They analyze confusion matrices, false positive rates, and precision-recall curves to identify model weaknesses and potential biases in credit decision-making. Regular validation of stress testing and backtesting results is critical to maintaining compliance with regulatory standards like Basel III and enhancing portfolio risk management.

Model Documentation

Credit Risk Model Validation Specialists ensure comprehensive model documentation that complies with regulatory standards such as Basel III and SR 11-7 guidelines. Accurate and detailed documentation includes model assumptions, data sources, validation methodologies, and performance metrics, facilitating transparency and audit readiness. This specialization enhances risk management by enabling consistent model review and effective communication across credit risk management teams.

Data Quality Assessment

A Credit Risk Model Validation Specialist ensures the integrity and reliability of credit risk models by conducting rigorous Data Quality Assessments. This process involves analyzing data sources for completeness, accuracy, and consistency to support robust model validation and regulatory compliance. Effective data quality assessment mitigates model risk and enhances decision-making in credit risk management.

kuljobs.com

kuljobs.com