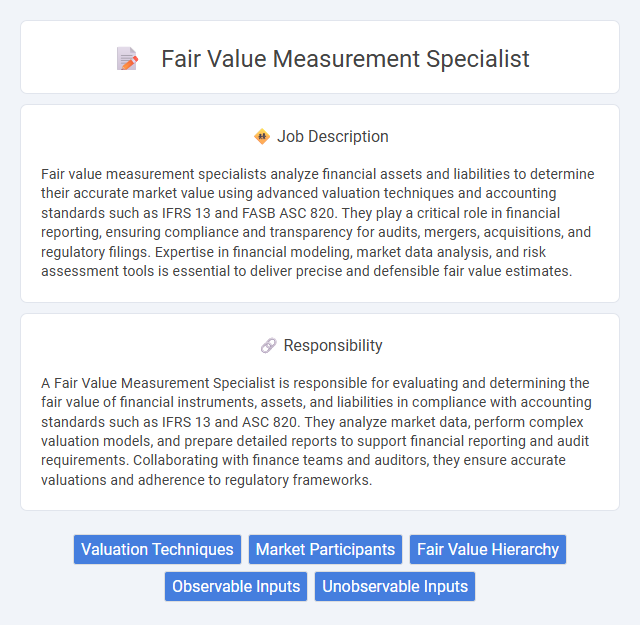

Fair value measurement specialists analyze financial assets and liabilities to determine their accurate market value using advanced valuation techniques and accounting standards such as IFRS 13 and FASB ASC 820. They play a critical role in financial reporting, ensuring compliance and transparency for audits, mergers, acquisitions, and regulatory filings. Expertise in financial modeling, market data analysis, and risk assessment tools is essential to deliver precise and defensible fair value estimates.

Individuals with strong analytical skills and attention to detail are likely well-suited for a fair value measurement specialist role. Those comfortable navigating complex financial models and interpreting market data may find this position aligns with their strengths. It is probable that candidates who thrive in environments requiring precision and independent judgment will excel in this job.

Qualification

Qualifications for a Fair Value Measurement Specialist include a strong background in finance, accounting, or economics, often supported by a bachelor's or master's degree. Proficiency in financial modeling, valuation techniques, and knowledge of GAAP or IFRS standards is essential for accurate fair value assessments. Experience with data analysis tools and strong analytical skills enhance capability to interpret complex financial data and support reliable asset valuation.

Responsibility

A Fair Value Measurement Specialist is responsible for evaluating and determining the fair value of financial instruments, assets, and liabilities in compliance with accounting standards such as IFRS 13 and ASC 820. They analyze market data, perform complex valuation models, and prepare detailed reports to support financial reporting and audit requirements. Collaborating with finance teams and auditors, they ensure accurate valuations and adherence to regulatory frameworks.

Benefit

Fair value measurement specialists likely enhance financial accuracy by applying rigorous valuation techniques that improve asset and liability assessments. Their expertise probably supports companies in achieving regulatory compliance and making informed investment decisions. This role seemingly adds significant value by reducing risks associated with misvaluation and promoting transparent financial reporting.

Challenge

Fair value measurement specialists likely face challenges in accurately assessing asset valuations due to fluctuating market conditions and evolving accounting standards. The complexity of interpreting diverse financial instruments and ensuring compliance with regulatory frameworks may increase the difficulty of delivering precise measurements. Navigating ambiguity in data sources and maintaining methodological consistency are probable ongoing obstacles within this role.

Career Advancement

Fair value measurement specialists enhance their expertise in asset valuation, financial reporting, and regulatory compliance, positioning themselves for leadership roles in finance and accounting. Mastery of IFRS 13 and ASC 820 standards opens pathways to senior analyst or managerial positions within investment firms, banks, and auditing companies. Continuous professional development and certifications, such as CFA or CPA, significantly boost career growth and salary prospects in this specialized field.

Key Terms

Valuation Techniques

Fair value measurement specialists utilize advanced valuation techniques such as discounted cash flow (DCF) analysis, market approach, and income approach to accurately assess asset and liability values in compliance with IFRS 13 and ASC 820 standards. They apply statistical models and scenario analysis to estimate fair value under varying market conditions, ensuring precise financial reporting and risk assessment. Expertise in analyzing market data, comparable transactions, and economic indicators is crucial for robust valuation and audit support.

Market Participants

A Fair Value Measurement Specialist evaluates asset and liability prices based on how market participants would price them in orderly transactions. This role requires deep understanding of market participant assumptions, including risk tolerance, transaction motivations, and available information. Expertise in applying IFRS 13 or ASC 820 standards ensures accurate fair value estimations reflecting current market conditions.

Fair Value Hierarchy

A Fair Value Measurement Specialist expertly applies the Fair Value Hierarchy to classify assets and liabilities based on observable and unobservable inputs. This role involves using Level 1 inputs from active markets, Level 2 inputs derived from similar assets, and Level 3 inputs relying on management assumptions to ensure accurate valuation. Expertise in IFRS 13 and ASC 820 standards is critical for consistent and compliant financial reporting.

Observable Inputs

Fair value measurement specialists analyze market data to determine asset valuations using observable inputs such as quoted prices, market interest rates, and reported transactions from relevant markets. They apply Level 2 inputs under IFRS 13 and ASC 820 frameworks, ensuring valuation models are supported by transparent, objective data rather than unobservable assumptions. Precision in sourcing and interpreting these inputs is crucial for compliance, accuracy in financial reporting, and auditing processes.

Unobservable Inputs

Fair value measurement specialists analyze unobservable inputs to estimate asset and liability valuations where market data is unavailable, applying Level 3 inputs in accordance with IFRS 13 and ASC 820 standards. They use advanced valuation models, such as discounted cash flows and option pricing, to derive assumptions like volatility, credit risk, and future cash flows that impact fair value. Expertise in financial modeling, critical judgment, and regulatory compliance ensures accurate reporting and audit readiness for complex financial instruments.

kuljobs.com

kuljobs.com