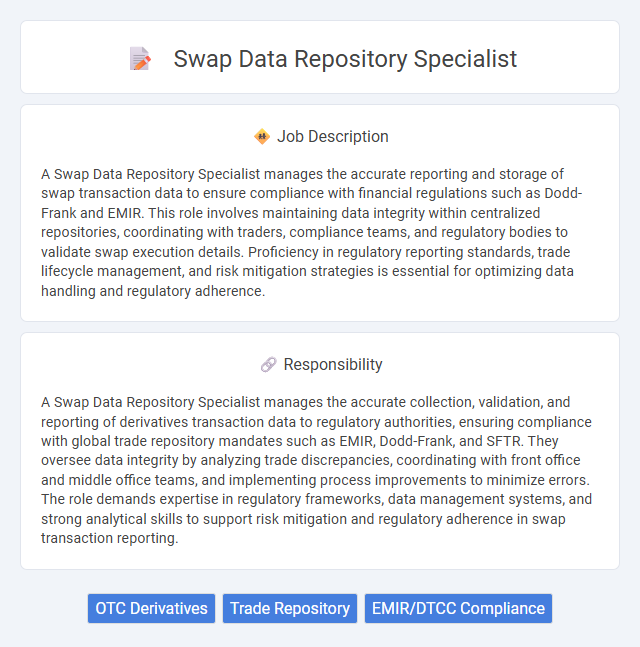

A Swap Data Repository Specialist manages the accurate reporting and storage of swap transaction data to ensure compliance with financial regulations such as Dodd-Frank and EMIR. This role involves maintaining data integrity within centralized repositories, coordinating with traders, compliance teams, and regulatory bodies to validate swap execution details. Proficiency in regulatory reporting standards, trade lifecycle management, and risk mitigation strategies is essential for optimizing data handling and regulatory adherence.

Individuals with strong analytical skills and attention to detail are likely to be suitable for the Swap Data Repository Specialist role, as it involves managing complex financial data accurately. Those comfortable with regulatory environments and data compliance may find this position aligns well with their strengths, increasing their probability of success. Candidates lacking precision or familiarity with financial instruments might struggle to meet the job's demands.

Qualification

Expertise in financial data management and derivatives markets is essential for a Swap Data Repository Specialist. Proficiency in regulatory reporting standards such as Dodd-Frank, EMIR, and SFTR ensures accurate submission of swap transaction data. Strong analytical skills combined with experience in data validation, reconciliation, and database management tools are critical qualifications for this role.

Responsibility

A Swap Data Repository Specialist manages the accurate collection, validation, and reporting of derivatives transaction data to regulatory authorities, ensuring compliance with global trade repository mandates such as EMIR, Dodd-Frank, and SFTR. They oversee data integrity by analyzing trade discrepancies, coordinating with front office and middle office teams, and implementing process improvements to minimize errors. The role demands expertise in regulatory frameworks, data management systems, and strong analytical skills to support risk mitigation and regulatory adherence in swap transaction reporting.

Benefit

Working as a Swap Data Repository Specialist likely offers significant benefits such as enhanced expertise in financial regulations and data management, which can improve career prospects in the finance industry. The role probably provides opportunities to work with cutting-edge technology platforms designed for trade reporting and compliance, potentially increasing job security due to high demand. Employees may also enjoy competitive compensation and the possibility of global industry exposure, contributing to professional growth and networking.

Challenge

The role of a Swap Data Repository Specialist likely presents challenges related to managing vast amounts of complex derivatives data with high accuracy and compliance requirements. Navigating stringent regulatory frameworks while ensuring timely and error-free reporting may require advanced analytical skills and attention to detail. This position probably demands adaptability to rapidly evolving market conditions and reporting standards.

Career Advancement

A Swap Data Repository Specialist plays a crucial role in managing and maintaining comprehensive swap transaction records, ensuring compliance with regulatory requirements such as Dodd-Frank and EMIR. Mastery in data analytics, regulatory reporting, and risk management opens pathways to senior roles like Compliance Manager or Risk Analyst within financial institutions. Continuous skills development and certifications in financial regulations significantly enhance career advancement opportunities in this evolving domain.

Key Terms

OTC Derivatives

A Swap Data Repository Specialist manages and ensures the accurate reporting of over-the-counter (OTC) derivatives transactions in compliance with regulatory frameworks such as EMIR and Dodd-Frank. They maintain data integrity within centralized repositories, analyze trade lifecycle events, and collaborate with front-office and risk teams to resolve discrepancies. Proficiency in swap instrument structures, regulatory reporting standards, and data validation processes is essential for optimizing trade transparency and mitigating operational risk.

Trade Repository

A Swap Data Repository Specialist manages the accurate collection, validation, and reporting of derivative trade data to ensure compliance with regulatory requirements such as EMIR and Dodd-Frank. They maintain and monitor trade repositories to facilitate transparency and reduce systemic risk in OTC derivatives markets by coordinating with trade counterparties and regulatory bodies. Expertise in trade capture systems, data quality controls, and regulatory reporting frameworks is essential for optimizing trade lifecycle management.

EMIR/DTCC Compliance

A Swap Data Repository Specialist ensures accurate reporting and compliance with EMIR (European Market Infrastructure Regulation) and DTCC (Depository Trust & Clearing Corporation) standards, managing the submission and validation of swap transaction data. Expertise in regulatory requirements, trade lifecycle management, and data reconciliation processes enables the specialist to address discrepancies and maintain data integrity across platforms. Proficiency in regulatory reporting tools and understanding of derivatives markets is critical for reducing compliance risk and supporting audit readiness.

kuljobs.com

kuljobs.com