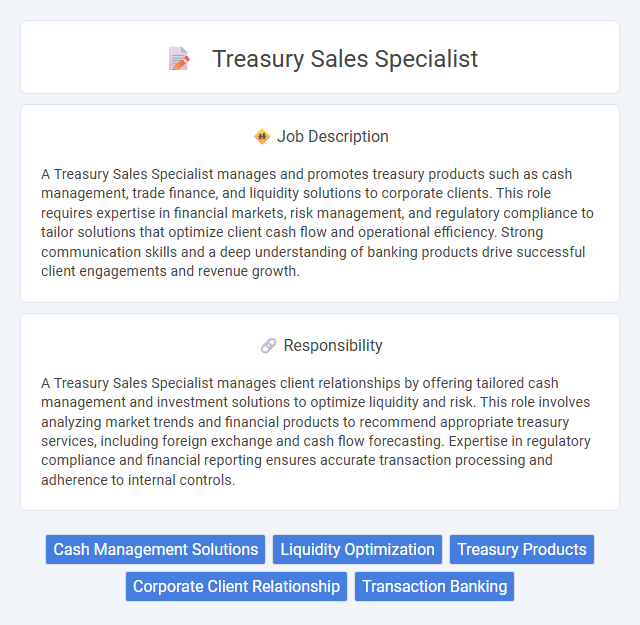

A Treasury Sales Specialist manages and promotes treasury products such as cash management, trade finance, and liquidity solutions to corporate clients. This role requires expertise in financial markets, risk management, and regulatory compliance to tailor solutions that optimize client cash flow and operational efficiency. Strong communication skills and a deep understanding of banking products drive successful client engagements and revenue growth.

Individuals with strong analytical skills and attention to detail are likely to thrive as Treasury Sales Specialists, as the role requires managing complex financial transactions and understanding market conditions. Those comfortable with high-pressure environments and adept at communication may find the position well-suited to their capabilities. Conversely, people who struggle with fast-paced decision-making or lack interest in financial markets might not be ideal candidates for this job.

Qualification

A Treasury Sales Specialist typically requires a strong background in finance, economics, or business administration, often supported by a bachelor's or master's degree. Expertise in financial markets, cash management, and risk assessment is essential, alongside proficiency in treasury management systems and regulatory compliance. Strong analytical, communication, and client relationship skills are crucial to effectively tailor cash management and investment solutions to meet corporate clients' treasury needs.

Responsibility

A Treasury Sales Specialist manages client relationships by offering tailored cash management and investment solutions to optimize liquidity and risk. This role involves analyzing market trends and financial products to recommend appropriate treasury services, including foreign exchange and cash flow forecasting. Expertise in regulatory compliance and financial reporting ensures accurate transaction processing and adherence to internal controls.

Benefit

Treasury sales specialists likely provide significant benefits by offering tailored financial solutions that optimize clients' cash flow and manage risk effectively. Their expertise probably enhances client satisfaction through personalized service and strategic advice, contributing to stronger business relationships. Employers may also benefit from increased revenue and market presence due to the specialist's ability to identify and capitalize on treasury product opportunities.

Challenge

A Treasury Sales Specialist role likely involves navigating complex financial markets and managing high-pressure client interactions, making it a challenging position requiring sharp analytical skills. The job probably demands staying updated on market trends and regulatory changes to offer tailored treasury solutions, which may test one's adaptability. Handling large transactions and mitigating financial risks could present constant challenges that require strategic thinking and problem-solving capabilities.

Career Advancement

A Treasury Sales Specialist plays a crucial role in managing corporate liquidity, cash flow, and risk by offering tailored financial solutions including cash management, payment services, and investment products. Mastery in client relationship management and deep understanding of treasury products opens pathways to advanced roles such as Treasury Manager, Senior Sales Executive, or Corporate Finance Consultant. Leveraging expertise in market trends, regulatory compliance, and innovative financial technologies accelerates career growth within banking institutions and financial services firms.

Key Terms

Cash Management Solutions

A Treasury Sales Specialist in Cash Management Solutions develops and promotes customized cash handling and liquidity strategies to optimize corporate treasury operations. Expertise in payment processing, fraud prevention, and cash flow forecasting enables the specialist to deliver tailored products such as ACH services, wire transfers, and sweep accounts. Collaboration with financial institutions and corporate clients ensures seamless integration of technology-driven cash management platforms that enhance efficiency and reduce operational risks.

Liquidity Optimization

A Treasury Sales Specialist focuses on liquidity optimization by implementing strategies that ensure efficient cash flow management and maximize surplus cash utilization. They analyze market trends and client portfolios to advise on short-term investment opportunities and cash positioning. Expertise in liquidity forecasting and risk assessment enables them to enhance financial flexibility and support organizational stability.

Treasury Products

Treasury sales specialists focus on promoting and selling a range of treasury products such as cash management solutions, foreign exchange services, and liquidity products to corporate clients. They leverage deep knowledge of treasury instruments to tailor financial strategies that optimize clients' cash flow, risk management, and investment needs. Mastery of market trends and product features enables specialists to effectively identify client needs and deliver customized treasury solutions.

Corporate Client Relationship

Treasury sales specialists manage corporate client relationships by providing tailored financial solutions that optimize cash flow, liquidity, and risk management. Their expertise in treasury products, such as payment systems, foreign exchange, and investment options, enables them to align banking services with complex corporate treasury needs. Effective communication and deep understanding of client business models are essential for fostering long-term partnerships and driving revenue growth.

Transaction Banking

A Treasury Sales Specialist in Transaction Banking drives tailored cash management and liquidity solutions for corporate clients, enhancing financial efficiency and risk management. Expertise in payment systems, treasury products, and regulatory compliance ensures seamless transaction processing and optimized working capital. Collaboration with relationship managers and product teams accelerates client acquisition and revenue growth through innovative treasury services.

kuljobs.com

kuljobs.com