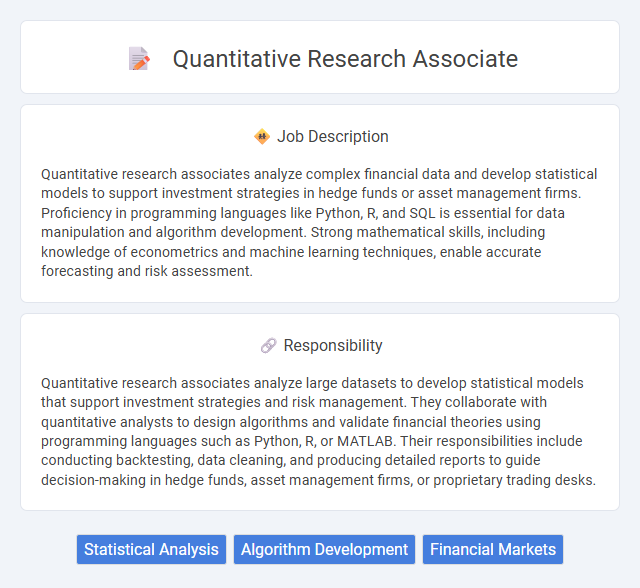

Quantitative research associates analyze complex financial data and develop statistical models to support investment strategies in hedge funds or asset management firms. Proficiency in programming languages like Python, R, and SQL is essential for data manipulation and algorithm development. Strong mathematical skills, including knowledge of econometrics and machine learning techniques, enable accurate forecasting and risk assessment.

Individuals with strong analytical skills and a passion for data are likely to be well-suited for a Quantitative Research Associate role. Those comfortable working with statistical software and complex models might find this job engaging and rewarding. Candidates who prefer structured environments and enjoy problem-solving through numbers could probably thrive in this position.

Qualification

A Quantitative Research Associate typically holds a master's or doctoral degree in statistics, mathematics, finance, computer science, or a related quantitative discipline. Proficiency in programming languages such as Python, R, or MATLAB, along with strong skills in data analysis, statistical modeling, and machine learning, is essential. Experience with financial modeling, econometrics, and working knowledge of databases and data visualization tools further enhances qualification for this role.

Responsibility

Quantitative research associates analyze large datasets to develop statistical models that support investment strategies and risk management. They collaborate with quantitative analysts to design algorithms and validate financial theories using programming languages such as Python, R, or MATLAB. Their responsibilities include conducting backtesting, data cleaning, and producing detailed reports to guide decision-making in hedge funds, asset management firms, or proprietary trading desks.

Benefit

Quantitative research associate roles likely offer benefits such as competitive salaries and performance-based bonuses, reflecting the high demand for data-driven decision-making skills. Employees may experience opportunities for professional growth through exposure to cutting-edge analytics tools and collaboration with industry experts. Access to comprehensive health plans and flexible work arrangements could also be typical perks supporting work-life balance.

Challenge

Quantitative research associate roles likely present challenges involving complex data analysis and model development under tight deadlines, testing problem-solving skills consistently. Navigating large datasets and ensuring accurate interpretation of statistical results probably requires strong technical proficiency and attention to detail. The dynamic nature of financial markets or research environments often demands quick adaptation to evolving methodologies and tools.

Career Advancement

Quantitative research associates play a crucial role in analyzing complex data sets and developing mathematical models to support investment strategies, enhancing their expertise in financial markets and statistical techniques. Career advancement opportunities often include roles such as senior quantitative analyst, quantitative research manager, or portfolio manager, which allow for greater responsibility and influence over trading decisions. Mastery of programming languages like Python or R, along with strong analytical skills, significantly improves promotion prospects within top-tier financial institutions.

Key Terms

Statistical Analysis

A Quantitative Research Associate specializes in statistical analysis to interpret complex data sets and generate actionable insights. Proficiency in statistical software like R, SAS, or Python is essential for designing experiments, conducting hypothesis testing, and building predictive models. Strong expertise in data visualization and data cleaning ensures accurate, reliable results that support data-driven decision-making across various industries.

Algorithm Development

A Quantitative Research Associate specializing in Algorithm Development applies advanced mathematical models and statistical techniques to design and implement algorithms that enhance financial trading strategies. Proficiency in programming languages such as Python, C++, or R is essential for developing robust, high-frequency trading systems and back-testing models against large datasets. Collaboration with data scientists and quantitative analysts ensures the continuous optimization and execution of algorithms to maximize trading performance and risk-adjusted returns.

Financial Markets

A Quantitative Research Associate in Financial Markets develops mathematical models and algorithms to analyze market data, identify trading opportunities, and manage risk. Expertise in statistical methods, programming languages such as Python or R, and familiarity with financial instruments like equities, derivatives, and fixed income is essential. This role requires strong analytical skills to support portfolio optimization, high-frequency trading strategies, and predictive market analysis.

kuljobs.com

kuljobs.com