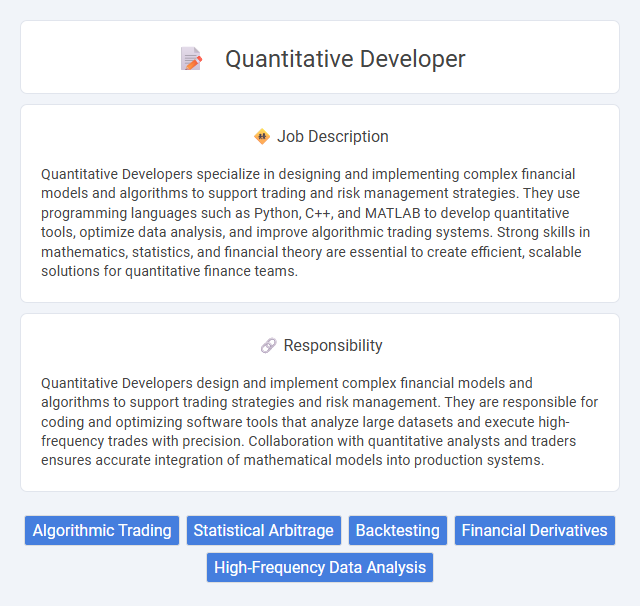

Quantitative Developers specialize in designing and implementing complex financial models and algorithms to support trading and risk management strategies. They use programming languages such as Python, C++, and MATLAB to develop quantitative tools, optimize data analysis, and improve algorithmic trading systems. Strong skills in mathematics, statistics, and financial theory are essential to create efficient, scalable solutions for quantitative finance teams.

Individuals with strong analytical skills, proficiency in programming, and a solid background in mathematics or finance are likely to excel as Quantitative Developers. Those who thrive in fast-paced environments, enjoy problem-solving, and have a high tolerance for complex data analysis may find this role particularly suitable. Conversely, candidates who struggle with coding or lack interest in quantitative modeling might find the demands of the job challenging and less fulfilling.

Qualification

A Quantitative Developer requires strong expertise in programming languages such as Python, C++, and Java, combined with deep knowledge of financial mathematics and statistical modeling. Proficiency in algorithms, data structures, and machine learning techniques is essential for developing and optimizing trading strategies and risk management tools. A background in quantitative finance, computer science, or applied mathematics, often supported by advanced degrees, enhances the ability to implement efficient and scalable solutions in high-frequency trading environments.

Responsibility

Quantitative Developers design and implement complex financial models and algorithms to support trading strategies and risk management. They are responsible for coding and optimizing software tools that analyze large datasets and execute high-frequency trades with precision. Collaboration with quantitative analysts and traders ensures accurate integration of mathematical models into production systems.

Benefit

Quantitative Developer roles likely offer significant financial rewards due to their specialized skill set in programming and quantitative finance. They may also provide opportunities for continuous learning and professional growth through exposure to advanced modeling techniques and cutting-edge technologies. The collaborative environment within financial firms could enhance problem-solving skills and career advancement prospects.

Challenge

Quantitative Developer roles often present complex challenges involving the design and implementation of sophisticated algorithms to analyze large financial datasets. The position likely demands continuous adaptation to rapidly evolving market conditions and the integration of cutting-edge technologies. Success in this role probably hinges on strong problem-solving skills and the ability to navigate high-pressure environments with precision.

Career Advancement

A Quantitative Developer role offers significant career advancement opportunities through the mastery of algorithmic trading models, financial data analysis, and software engineering within quantitative finance. Progression typically leads to senior quantitative developer positions, quantitative research management, or specialized roles such as algorithmic strategist, with increased responsibilities in designing and optimizing complex trading systems. Continuous learning in machine learning, high-frequency trading, and risk management technologies further enhances promotion prospects and industry expertise.

Key Terms

Algorithmic Trading

Quantitative Developers specializing in algorithmic trading design, test, and implement complex trading algorithms that leverage large-scale financial data and machine learning models to optimize investment strategies. Proficiency in programming languages such as Python, C++, and SQL is essential for developing high-frequency trading systems and backtesting frameworks. Strong knowledge of stochastic calculus, statistical analysis, and market microstructure enables these developers to enhance execution efficiency and minimize trading risks.

Statistical Arbitrage

Quantitative Developers specializing in Statistical Arbitrage design and implement sophisticated algorithms to exploit price inefficiencies across financial markets, leveraging statistical models and high-frequency data analysis. They utilize advanced programming languages such as Python, C++, and R to build robust trading systems that optimize execution speed and minimize risk exposure. Their expertise in time-series analysis, machine learning, and stochastic calculus is crucial for developing predictive models that drive automated trading strategies and enhance portfolio performance.

Backtesting

Quantitative developers specializing in backtesting design and implement robust algorithms to simulate trading strategies against historical market data. Their role involves optimizing code efficiency to ensure accurate performance analysis and risk assessment within complex financial models. Proficiency in programming languages like Python, C++, and expertise in data handling frameworks are essential to validate predictive models and support algorithmic trading decisions.

Financial Derivatives

Quantitative Developers specializing in financial derivatives design and implement complex models for pricing, hedging, and risk management of options, futures, and swaps. They utilize advanced programming languages like Python, C++, and SQL alongside stochastic calculus and Monte Carlo simulations to optimize trading strategies and ensure regulatory compliance. Expertise in financial mathematics, machine learning, and real-time data integration is essential to support algorithmic trading and portfolio optimization in dynamic markets.

High-Frequency Data Analysis

Quantitative Developers specialized in High-Frequency Data Analysis design and implement algorithms to process and analyze vast streams of real-time market data, optimizing trading strategies for milliseconds-level execution. They utilize advanced statistical models, machine learning techniques, and programming languages like Python, C++, and MATLAB to extract actionable insights from noisy, high-velocity datasets. Expertise in low-latency systems and distributed computing frameworks is essential to ensure rapid data processing and seamless integration within algorithmic trading platforms.

kuljobs.com

kuljobs.com