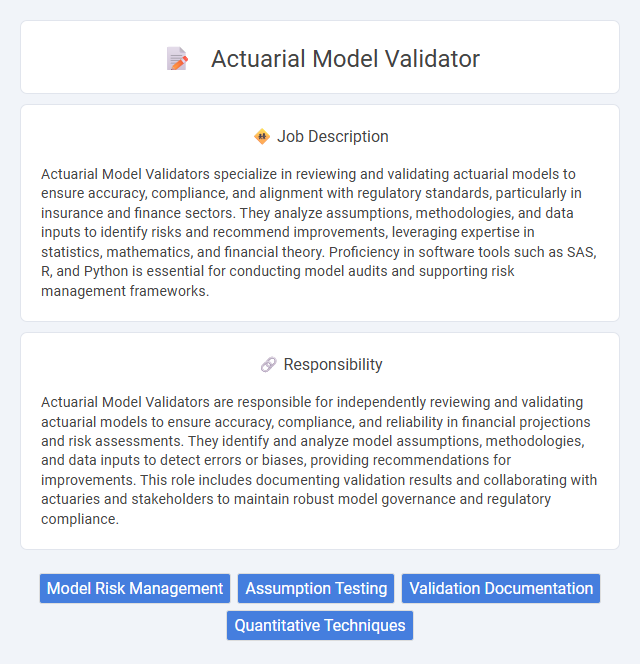

Actuarial Model Validators specialize in reviewing and validating actuarial models to ensure accuracy, compliance, and alignment with regulatory standards, particularly in insurance and finance sectors. They analyze assumptions, methodologies, and data inputs to identify risks and recommend improvements, leveraging expertise in statistics, mathematics, and financial theory. Proficiency in software tools such as SAS, R, and Python is essential for conducting model audits and supporting risk management frameworks.

Individuals with strong analytical skills and a keen attention to detail are likely to be well-suited for the role of an Actuarial Model Validator, as the job requires thorough examination of complex financial models. Those who enjoy working with data, possess a strong understanding of actuarial principles, and can communicate findings effectively might find the position engaging and rewarding. Candidates who struggle with precision or have difficulty interpreting mathematical models might face challenges succeeding in this role.

Qualification

An Actuarial Model Validator typically requires a strong background in actuarial science, with professional credentials such as the ASA or FSA designation from recognized actuarial bodies. Proficiency in statistical modeling, risk assessment, and programming languages like Python or R is essential for validating complex actuarial models effectively. Candidates must demonstrate expertise in regulatory frameworks, data analysis, and communication skills to interpret and report validation results accurately.

Responsibility

Actuarial Model Validators are responsible for independently reviewing and validating actuarial models to ensure accuracy, compliance, and reliability in financial projections and risk assessments. They identify and analyze model assumptions, methodologies, and data inputs to detect errors or biases, providing recommendations for improvements. This role includes documenting validation results and collaborating with actuaries and stakeholders to maintain robust model governance and regulatory compliance.

Benefit

Actuarial Model Validator roles likely offer substantial benefits including enhanced risk assessment accuracy and improved regulatory compliance. Professionals in this position probably gain valuable expertise in model validation techniques, increasing their marketability within the financial industry. The role may also provide opportunities to work with advanced statistical tools and contribute to more robust decision-making processes.

Challenge

Actuarial Model Validator roles likely present significant challenges in ensuring the accuracy and robustness of complex financial models under uncertain assumptions. Candidates may face difficulties in identifying model risks and biases while maintaining compliance with regulatory standards. The position probably demands a high level of analytical skill and attention to detail to validate models effectively in a rapidly evolving financial environment.

Career Advancement

Actuarial Model Validator roles offer a critical pathway for career advancement within the insurance and finance sectors by developing expertise in risk assessment and regulatory compliance. Professionals in this position enhance their technical skills in statistical analysis, coding, and model governance, positioning themselves for senior roles such as Chief Risk Officer or Head of Model Validation. Mastery of complex actuarial models and regulatory frameworks accelerates career growth and opens opportunities for leadership in strategic decision-making.

Key Terms

Model Risk Management

Actuarial Model Validators specialize in assessing the accuracy, reliability, and compliance of actuarial models used in insurance and financial sectors to ensure effective Model Risk Management. They analyze assumptions, validate methodologies, and monitor model performance against regulatory standards such as SR 11-7 and Solvency II to mitigate risks related to model inaccuracies. Expertise in stochastic modeling, statistical analysis, and regulatory frameworks enhances the robustness and transparency of predictive risk models within enterprise risk management processes.

Assumption Testing

Actuarial Model Validators specialize in Assumption Testing by critically evaluating the assumptions underlying actuarial models to ensure accuracy and reliability in financial forecasting. They analyze historical data, validate parameter selections, and assess the impact of assumptions on risk projections and reserve calculations. This role is essential for maintaining regulatory compliance and enhancing the robustness of pricing, reserving, and risk management models.

Validation Documentation

Actuarial Model Validators specialize in creating comprehensive validation documentation that ensures the accuracy and reliability of actuarial models used in risk assessment and financial forecasting. This documentation includes detailed reports on model assumptions, data integrity, validation methodologies, sensitivity analysis, and compliance with regulatory standards such as Solvency II or IFRS 17. Effective validation documentation supports transparency, facilitates audit processes, and strengthens confidence in model-driven business decisions within insurance and finance sectors.

Quantitative Techniques

Actuarial Model Validator roles require advanced quantitative techniques including statistical analysis, stochastic modeling, and risk assessment to evaluate the accuracy and reliability of actuarial models. Proficiency in programming languages such as R, Python, or SAS facilitates comprehensive data manipulation and model validation processes. Expertise in probability theory and mathematical statistics ensures robust evaluation of assumptions and model outputs within insurance, finance, and pension domains.

kuljobs.com

kuljobs.com