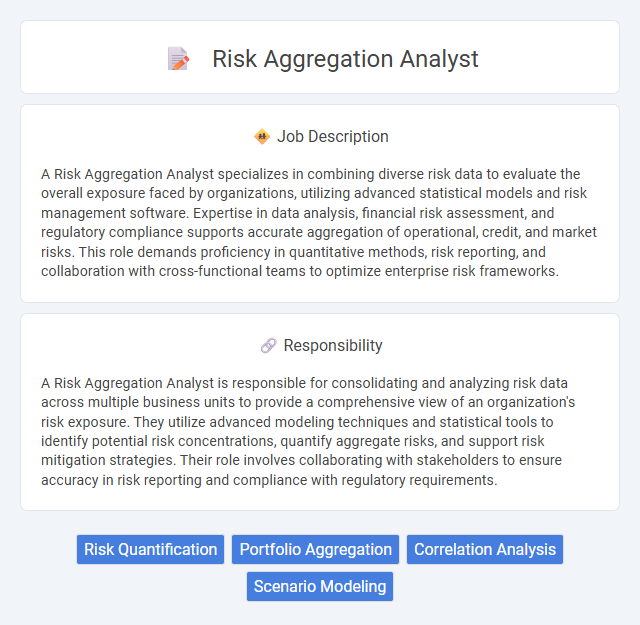

A Risk Aggregation Analyst specializes in combining diverse risk data to evaluate the overall exposure faced by organizations, utilizing advanced statistical models and risk management software. Expertise in data analysis, financial risk assessment, and regulatory compliance supports accurate aggregation of operational, credit, and market risks. This role demands proficiency in quantitative methods, risk reporting, and collaboration with cross-functional teams to optimize enterprise risk frameworks.

Individuals with strong analytical skills and a keen attention to detail are likely well-suited for a Risk Aggregation Analyst role. Those comfortable working with complex data sets and possessing a solid understanding of risk management principles may find this job aligns with their strengths. Candidates who thrive in high-pressure environments and can communicate risk insights effectively might have a higher probability of success in this position.

Qualification

A Risk Aggregation Analyst requires strong analytical skills and proficiency in statistical software such as SAS, R, or Python to interpret complex risk data across multiple business lines. A bachelor's degree in finance, actuarial science, mathematics, or a related field is essential, with advanced certifications like FRM or CFA preferred. Expertise in risk modeling, data integration techniques, and regulatory compliance standards enables effective aggregation and reporting of enterprise-wide risk exposures.

Responsibility

A Risk Aggregation Analyst is responsible for consolidating and analyzing risk data across multiple business units to provide a comprehensive view of an organization's risk exposure. They utilize advanced modeling techniques and statistical tools to identify potential risk concentrations, quantify aggregate risks, and support risk mitigation strategies. Their role involves collaborating with stakeholders to ensure accuracy in risk reporting and compliance with regulatory requirements.

Benefit

A Risk Aggregation Analyst likely enhances an organization's ability to identify and evaluate combined risks across various departments, improving overall risk visibility. This role probably optimizes decision-making by providing comprehensive risk data models that predict potential financial losses or operational impacts. Such insights can significantly benefit risk management strategies, potentially reducing unexpected exposures and strengthening regulatory compliance.

Challenge

Risk aggregation analyst roles likely involve the complex challenge of consolidating diverse risk data from multiple sources to provide a comprehensive view of an organization's risk exposure. Navigating disparate data systems and ensuring accuracy in risk models could pose significant difficulties, demanding strong analytical and technical skills. The role might also require continuous adaptation to evolving regulatory environments and emerging risk factors, increasing the job's complexity.

Career Advancement

Risk aggregation analysts leverage advanced data modeling and statistical techniques to assess and consolidate risk exposures across business units, enhancing organizational decision-making. Mastery in risk management software and regulatory compliance standards can accelerate promotions to senior analyst or risk management roles. Continuous professional development through certifications like FRM or PRM significantly boosts career advancement opportunities in the risk analytics domain.

Key Terms

Risk Quantification

A Risk Aggregation Analyst specializing in risk quantification systematically consolidates data from various sources to measure potential financial losses and exposure across portfolios. Utilizing advanced statistical models, Monte Carlo simulations, and value-at-risk (VaR) calculations, they quantify aggregate risks to inform strategic decision-making and regulatory compliance. Proficiency in risk management frameworks such as Basel III and Solvency II enhances their ability to deliver precise quantitative risk assessments for enterprise-wide risk mitigation.

Portfolio Aggregation

A Risk Aggregation Analyst specializing in portfolio aggregation evaluates and consolidates risk exposures across diverse financial assets to provide a comprehensive risk profile. This role involves leveraging quantitative models and advanced analytics to identify potential vulnerabilities and correlations within large investment portfolios. Expertise in statistical software, risk management frameworks, and regulatory compliance is essential to ensure accurate aggregation and effective risk mitigation strategies.

Correlation Analysis

Risk aggregation analysts utilize correlation analysis to evaluate dependencies between different risk factors, enabling accurate assessment of overall portfolio risk. By quantifying the degree of relationship among asset classes and financial instruments, they identify potential risk concentrations and diversification effects. This correlation-driven insight supports data-driven decision-making for optimizing risk management strategies and capital allocation.

Scenario Modeling

Risk aggregation analysts specialize in scenario modeling to assess the potential impact of multiple risk factors on an organization's financial stability. They develop complex models that simulate various adverse events, aggregating risks across different business units to identify vulnerabilities. Expertise in statistical analysis, stress testing, and data integration enables these analysts to provide actionable insights for risk mitigation and regulatory compliance.

kuljobs.com

kuljobs.com