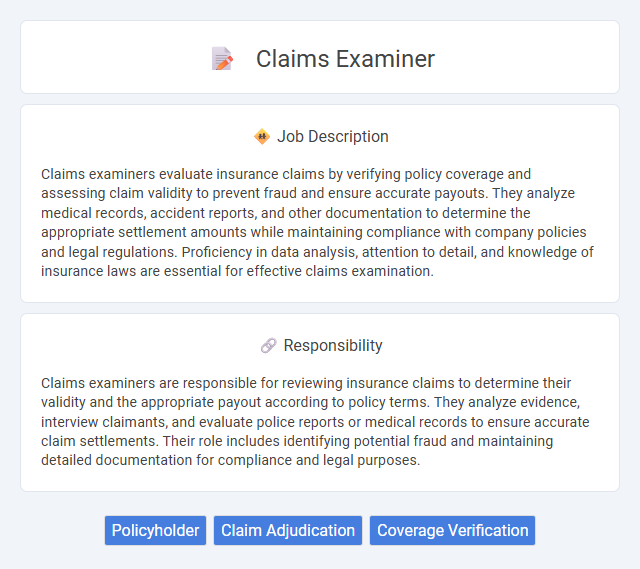

Claims examiners evaluate insurance claims by verifying policy coverage and assessing claim validity to prevent fraud and ensure accurate payouts. They analyze medical records, accident reports, and other documentation to determine the appropriate settlement amounts while maintaining compliance with company policies and legal regulations. Proficiency in data analysis, attention to detail, and knowledge of insurance laws are essential for effective claims examination.

People who are detail-oriented and have strong analytical skills are more likely to be suitable for a claims examiner job. Those with patience and the ability to handle stressful situations may find this role manageable despite complex case reviews. Individuals who struggle with repetitive tasks or high-pressure decision-making might face challenges in performing effectively as a claims examiner.

Qualification

Claims examiners typically require a high school diploma or equivalent, with many employers preferring candidates who have an associate's or bachelor's degree in fields like insurance, business, or finance. Strong analytical skills, attention to detail, and knowledge of insurance policies and regulations are essential qualifications for accurately evaluating insurance claims. Proficiency in computer software related to claims processing and effective communication skills are also critical for successful claims examiners.

Responsibility

Claims examiners are responsible for reviewing insurance claims to determine their validity and the appropriate payout according to policy terms. They analyze evidence, interview claimants, and evaluate police reports or medical records to ensure accurate claim settlements. Their role includes identifying potential fraud and maintaining detailed documentation for compliance and legal purposes.

Benefit

Claims examiners likely play a crucial role in assessing insurance claims, which may lead to significant benefits such as ensuring fair compensation and preventing fraudulent payouts. Their work probably helps insurance companies maintain financial stability and customer trust by accurately validating claims. Efficient claims examination might also speed up the settlement process, offering timely relief to policyholders.

Challenge

A claims examiner job likely presents significant challenges due to the complexity of evaluating diverse insurance claims accurately and efficiently. The role probably demands strong analytical skills to assess policy coverage and potential fraud while managing tight deadlines. Handling conflicting information and ensuring fair settlements may frequently require critical decision-making under pressure.

Career Advancement

Claims examiners analyze insurance claims to determine coverage and validity, playing a critical role in risk management and customer service. Career advancement opportunities include positions such as senior claims examiner, claims supervisor, or claims manager, often requiring specialized certifications like CPCU (Chartered Property Casualty Underwriter). Proficiency in data analysis, legal regulations, and negotiation enhances prospects for promotion within insurance companies or related financial sectors.

Key Terms

Policyholder

Claims examiners evaluate insurance claims to determine policyholder eligibility and coverage based on policy terms. They carefully analyze submitted documentation and investigate claim validity to protect both the policyholder's rights and the insurer's financial interests. Accurate assessment ensures timely claim resolution, improving policyholder satisfaction and trust in the insurance process.

Claim Adjudication

Claims examiners play a crucial role in the insurance industry by meticulously reviewing and adjudicating claims to determine their validity and compliance with policy terms. Proficient in regulatory guidelines and industry standards, they analyze documentation, assess coverage, and make informed decisions to approve or deny claims, ensuring accurate payout and fraud prevention. Expertise in claim adjudication enhances claim processing efficiency and reduces financial risk for insurers.

Coverage Verification

Claims examiners play a crucial role in insurance by verifying coverage to ensure claims are valid and comply with policy terms. They analyze policy documents, verify insured details, and assess coverage limits to prevent fraud and minimize financial losses. Accurate coverage verification enhances claim processing efficiency and maintains regulatory compliance within the insurance industry.

kuljobs.com

kuljobs.com