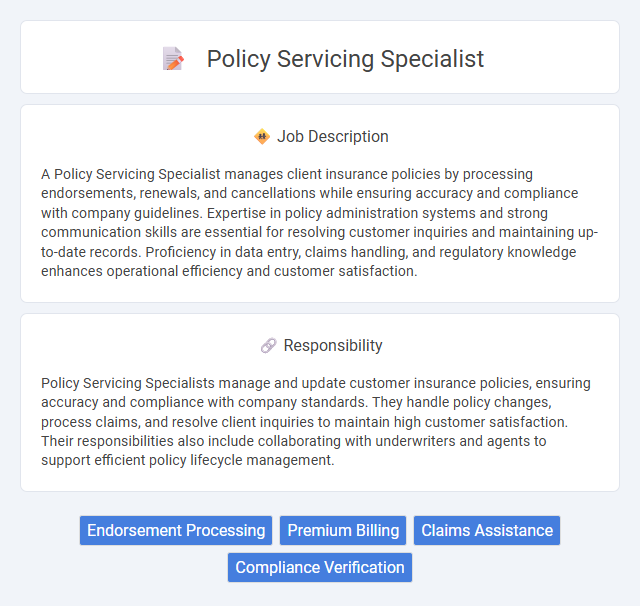

A Policy Servicing Specialist manages client insurance policies by processing endorsements, renewals, and cancellations while ensuring accuracy and compliance with company guidelines. Expertise in policy administration systems and strong communication skills are essential for resolving customer inquiries and maintaining up-to-date records. Proficiency in data entry, claims handling, and regulatory knowledge enhances operational efficiency and customer satisfaction.

Individuals with strong attention to detail and excellent communication skills are likely to be well-suited for a Policy Servicing Specialist role. Those who handle repetitive tasks efficiently and remain patient when addressing client concerns may find this position aligns with their strengths. Candidates who enjoy problem-solving within regulatory frameworks will probably thrive in this job.

Qualification

A Policy Servicing Specialist requires strong knowledge of insurance policies, claims processing, and customer service protocols. Key qualifications include proficiency in policy administration software, excellent communication skills, and the ability to analyze policy documentation accurately. Experience in risk assessment, regulatory compliance, and problem-solving enhances the candidate's effectiveness in managing client accounts and resolving service issues.

Responsibility

Policy Servicing Specialists manage and update customer insurance policies, ensuring accuracy and compliance with company standards. They handle policy changes, process claims, and resolve client inquiries to maintain high customer satisfaction. Their responsibilities also include collaborating with underwriters and agents to support efficient policy lifecycle management.

Benefit

A Policy Servicing Specialist likely enhances customer satisfaction by efficiently managing and resolving insurance policy inquiries, which may lead to improved client retention. This role probably ensures accurate and timely policy updates, reducing the risk of errors and compliance issues. Employers may benefit from streamlined operations and stronger relationships with policyholders due to the specialist's expertise.

Challenge

Handling complex policy inquiries and resolving discrepancies in customer accounts may present significant challenges for a Policy Servicing Specialist. The role likely demands a high level of accuracy and attention to detail, with potential pressure to meet strict deadlines and regulatory compliance standards. Navigating evolving insurance policies and adapting to frequent system updates could also add to the complexity of the job.

Career Advancement

Policy Servicing Specialists gain expertise in managing insurance policies, claims, and customer inquiries, positioning themselves for advancement into roles such as Underwriting Analyst or Claims Manager. Mastery of industry regulations, policy administration, and customer service skills enhances prospects for promotion to supervisory or managerial positions within insurance companies. Continuous professional development and certifications, like Chartered Property Casualty Underwriter (CPCU), further accelerate career growth in the insurance sector.

Key Terms

Endorsement Processing

Policy Servicing Specialists specializing in endorsement processing efficiently manage policy modifications by updating client information, coverage details, and risk factors within insurance systems. Their expertise ensures accuracy in policy adjustments, facilitating seamless communication between underwriters, agents, and policyholders to maintain compliance and customer satisfaction. Proficiency in using policy management software and understanding insurance regulations are critical for timely and error-free endorsement transactions.

Premium Billing

Policy Servicing Specialists expertly manage premium billing processes, ensuring accurate invoicing and timely payment collections to maintain policyholder accounts. They handle adjustments to billing schedules, reconcile payment discrepancies, and provide detailed billing information to clients and internal teams. Proficiency in insurance software systems and knowledge of regulatory compliance are essential for optimizing premium billing efficiency and customer satisfaction.

Claims Assistance

A Policy Servicing Specialist specializing in Claims Assistance expertly manages policyholder inquiries related to claims, ensuring accurate documentation and timely processing to enhance customer satisfaction. They coordinate between claimants and insurance adjusters, verifying claim validity and facilitating efficient resolution of disputes or issues. Proficiency in insurance regulations, data management systems, and customer communication is essential to optimize claim handling and maintain compliance.

Compliance Verification

A Policy Servicing Specialist ensures accurate compliance verification by meticulously reviewing insurance policies to confirm adherence to regulatory standards and internal guidelines. Their role involves auditing documentation, updating records, and coordinating with underwriting teams to resolve discrepancies promptly. Effective compliance verification minimizes risk exposure and supports the organization's commitment to legal and ethical operational practices.

kuljobs.com

kuljobs.com