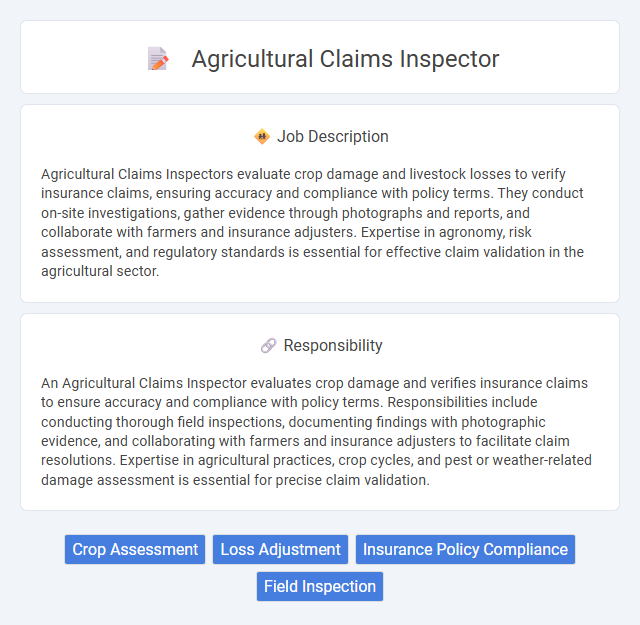

Agricultural Claims Inspectors evaluate crop damage and livestock losses to verify insurance claims, ensuring accuracy and compliance with policy terms. They conduct on-site investigations, gather evidence through photographs and reports, and collaborate with farmers and insurance adjusters. Expertise in agronomy, risk assessment, and regulatory standards is essential for effective claim validation in the agricultural sector.

Individuals with strong attention to detail and a background in agriculture or environmental science are likely suitable for the Agricultural Claims Inspector role. Candidates who are comfortable conducting field inspections and analyzing damage reports may find this job aligns well with their skills and interests. Those who prefer office-based work or lack physical stamina might face challenges adapting to the role's on-site demands.

Qualification

Agricultural Claims Inspectors typically require a bachelor's degree in agriculture, agribusiness, or a related field, along with knowledge of crop science, pest management, and insurance claims processes. Strong analytical skills and experience with field inspections, damage assessment, and report writing are essential qualifications. Certification in crop adjuster licensing and proficiency in relevant software enhance job performance and career advancement opportunities.

Responsibility

An Agricultural Claims Inspector evaluates crop damage and verifies insurance claims to ensure accuracy and compliance with policy terms. Responsibilities include conducting thorough field inspections, documenting findings with photographic evidence, and collaborating with farmers and insurance adjusters to facilitate claim resolutions. Expertise in agricultural practices, crop cycles, and pest or weather-related damage assessment is essential for precise claim validation.

Benefit

An Agricultural Claims Inspector likely provides significant benefits by ensuring accurate assessment and verification of crop damage or loss, which can expedite fair claim settlements for farmers. This role probably helps reduce fraudulent claims and supports the integrity of agricultural insurance programs. The position may also contribute to improved risk management and financial stability within the agricultural sector.

Challenge

The Agricultural Claims Inspector role likely presents challenges such as accurately assessing crop damage amid varying weather conditions and pest infestations. Navigating complex insurance policies and ensuring compliance with regulatory standards may require keen analytical skills and attention to detail. The job probably demands adaptability to rapidly changing field situations and effective communication with farmers and insurers.

Career Advancement

An Agricultural Claims Inspector evaluates insurance claims related to crop damage and livestock loss, collecting data on-site to ensure accurate assessments. Progression in this role often leads to supervisory positions, claim management, or specialized roles in agricultural risk assessment and policy development. Gaining certifications in insurance and agricultural sciences enhances career growth and opens opportunities within agricultural insurance companies and government agencies.

Key Terms

Crop Assessment

Agricultural Claims Inspectors specialize in evaluating crop damage to determine insurance claim validity, utilizing expertise in plant health and environmental factors. They conduct thorough field inspections, assess the extent of crop losses, and document findings to support accurate compensation for farmers. Proficiency in agronomy, disease identification, and weather impact analysis is essential for precise crop assessment and claim resolution.

Loss Adjustment

An Agricultural Claims Inspector specializes in assessing and verifying crop damage and livestock losses to accurately determine claim validity for insurance companies. Expertise in loss adjustment involves detailed field inspections, evidence collection, and analyzing environmental or pest-related impacts on agricultural production. Proficiency in interpreting insurance policies and collaborating with farmers ensures precise damage quantification and fair claim settlements.

Insurance Policy Compliance

Agricultural Claims Inspectors ensure insurance policy compliance by thoroughly evaluating damage reports and verifying claim legitimacy against policy terms. They conduct on-site inspections to assess crop, livestock, or equipment losses, documenting findings to support accurate claim settlements. Their expertise in agricultural practices and insurance regulations helps minimize fraud and maintain the integrity of insurance payouts.

Field Inspection

Agricultural Claims Inspectors specialize in conducting thorough field inspections to assess crop damage, verify insurance claims, and ensure compliance with agricultural regulations. They utilize advanced data collection tools, such as GPS mapping and digital imaging, to gather accurate information on plant health, soil conditions, and pest infestations. Their detailed reports support claim validation, risk evaluation, and the prevention of fraud in agricultural insurance processes.

kuljobs.com

kuljobs.com