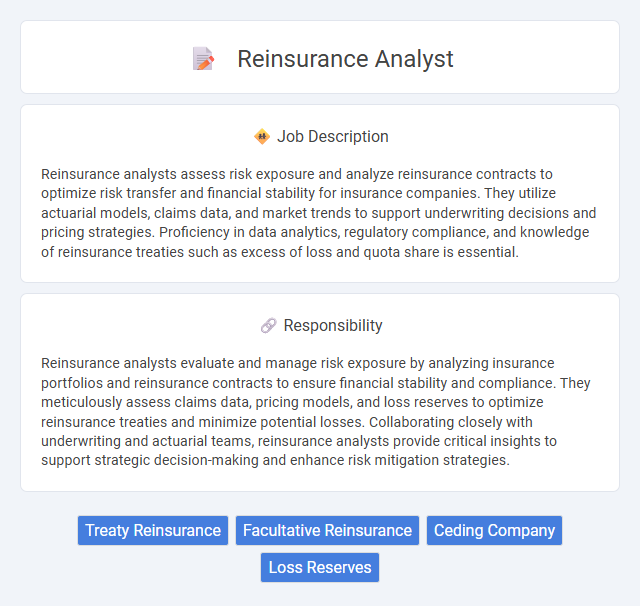

Reinsurance analysts assess risk exposure and analyze reinsurance contracts to optimize risk transfer and financial stability for insurance companies. They utilize actuarial models, claims data, and market trends to support underwriting decisions and pricing strategies. Proficiency in data analytics, regulatory compliance, and knowledge of reinsurance treaties such as excess of loss and quota share is essential.

Individuals with strong analytical skills, attention to detail, and a solid understanding of insurance principles are likely to be well-suited for a Reinsurance Analyst role. Those who prefer working with data, risk assessment, and financial models may find this job aligns with their strengths, while candidates who struggle with complex quantitative tasks might face challenges. The probability of success increases for people who are comfortable with collaborative environments and have effective communication abilities to explain technical information to non-experts.

Qualification

A Reinsurance Analyst requires strong analytical skills and a degree in finance, economics, or actuarial science, often supplemented by professional certifications such as CPCU or ASA. Proficiency in data analysis software, statistical modeling, and knowledge of reinsurance contracts and regulatory frameworks is essential. Experience with risk assessment, claim analysis, and financial reporting enhances the ability to optimize reinsurance portfolios and support underwriting decisions.

Responsibility

Reinsurance analysts evaluate and manage risk exposure by analyzing insurance portfolios and reinsurance contracts to ensure financial stability and compliance. They meticulously assess claims data, pricing models, and loss reserves to optimize reinsurance treaties and minimize potential losses. Collaborating closely with underwriting and actuarial teams, reinsurance analysts provide critical insights to support strategic decision-making and enhance risk mitigation strategies.

Benefit

A Reinsurance Analyst position likely offers the benefit of developing sharp analytical skills by assessing complex risk data and financial models. It may provide exposure to global insurance markets, enhancing industry knowledge and professional networks. This role probably supports career growth opportunities through hands-on experience with risk management and strategic decision-making processes.

Challenge

A Reinsurance Analyst may face the challenge of accurately assessing risk models in volatile markets, which can lead to unpredictable underwriting outcomes. The complexity of interpreting vast sets of data from multiple sources may increase the probability of analytical errors. Navigating regulatory changes and aligning them with reinsurance strategies often requires continuous adaptation and vigilant attention.

Career Advancement

A Reinsurance Analyst plays a crucial role in assessing risk and optimizing portfolio management within the insurance sector, utilizing data analytics and financial modeling to support strategic decisions. Mastery of industry-specific software and regulatory knowledge positions analysts for progression into senior underwriting, risk management, or actuarial roles. Continuous professional development through certifications like CPCU or ARM enhances career prospects and leadership opportunities in global insurance firms.

Key Terms

Treaty Reinsurance

A Treaty Reinsurance Analyst specializes in assessing and managing ongoing contracts that cover a portfolio of risks shared between insurers and reinsurers. They analyze loss data, evaluate risk exposure, and support pricing strategies to optimize reinsurance treaties and improve financial stability. Expertise in actuarial modeling, risk assessment, and industry regulations is critical for accurately forecasting liabilities and enhancing treaty structures.

Facultative Reinsurance

A Reinsurance Analyst specializing in Facultative Reinsurance evaluates individual risks that ceding insurers seek to transfer, analyzing policy terms, loss exposure, and underwriting data to determine appropriate coverage and pricing. Proficiency in risk assessment models and the ability to interpret complex reinsurance contracts are crucial for accurately recommending facultative agreements. This role supports insurers by mitigating potential losses through tailored risk-sharing strategies within facultative reinsurance transactions.

Ceding Company

A Reinsurance Analyst in a ceding company evaluates risk portfolios and analyzes reinsurance contracts to optimize coverage and minimize financial exposure. They perform detailed loss modeling, monitor treaty performance, and ensure compliance with regulatory requirements specific to ceded risks. Accurate data analysis and reporting enable ceding companies to negotiate better terms and enhance overall risk management strategies.

Loss Reserves

Reinsurance Analysts specializing in Loss Reserves evaluate and monitor outstanding claims to ensure accurate financial reporting and risk management. They use actuarial models and historical claim data to estimate the future liabilities of reinsurance contracts. Expertise in loss development factors and reserve risk analysis is essential for optimizing reserve adequacy and supporting regulatory compliance.

kuljobs.com

kuljobs.com