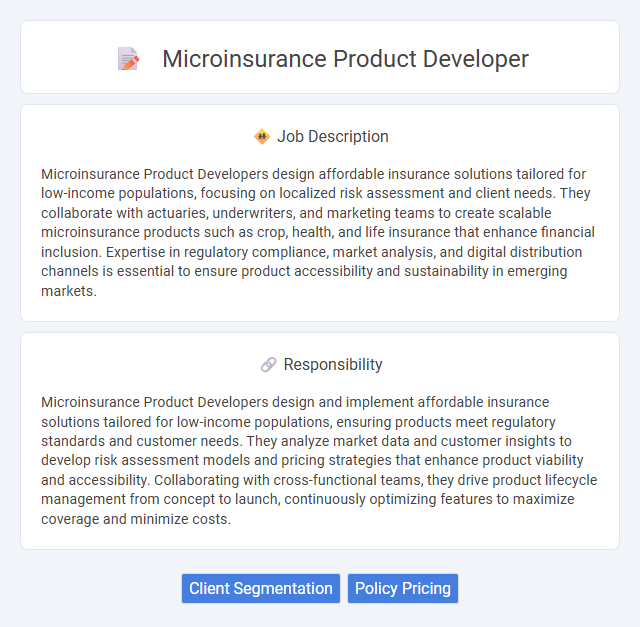

Microinsurance Product Developers design affordable insurance solutions tailored for low-income populations, focusing on localized risk assessment and client needs. They collaborate with actuaries, underwriters, and marketing teams to create scalable microinsurance products such as crop, health, and life insurance that enhance financial inclusion. Expertise in regulatory compliance, market analysis, and digital distribution channels is essential to ensure product accessibility and sustainability in emerging markets.

Individuals with a strong analytical mindset and a passion for financial inclusion are likely to be well-suited for a Microinsurance Product Developer role. Those who possess the ability to understand underserved communities' needs and translate complex data into practical insurance solutions might find this job rewarding. Candidates lacking empathy or interest in social impact may struggle to align with the core objectives of microinsurance product development.

Qualification

A Microinsurance Product Developer requires expertise in insurance product design, risk assessment, and market analysis tailored to low-income populations. Proficiency in data analytics, actuarial science, and regulatory compliance is essential to create affordable, innovative microinsurance solutions. Strong skills in stakeholder collaboration, financial modeling, and user-centric product development enhance the effectiveness and scalability of microinsurance offerings.

Responsibility

Microinsurance Product Developers design and implement affordable insurance solutions tailored for low-income populations, ensuring products meet regulatory standards and customer needs. They analyze market data and customer insights to develop risk assessment models and pricing strategies that enhance product viability and accessibility. Collaborating with cross-functional teams, they drive product lifecycle management from concept to launch, continuously optimizing features to maximize coverage and minimize costs.

Benefit

Microinsurance product developers likely enhance financial inclusion by creating affordable insurance solutions tailored to low-income populations. Their work probably improves risk management for vulnerable communities, offering protection against unexpected events that could otherwise cause significant hardship. This role may also drive innovation in the insurance sector, increasing accessibility and customer engagement through customized and simplified products.

Challenge

A Microinsurance Product Developer likely faces challenges in designing affordable and accessible insurance products for low-income populations while maintaining financial sustainability. The role probably requires navigating complex regulatory environments and understanding diverse customer needs in underserved markets. Balancing innovation with risk management may also be a significant part of overcoming obstacles in this position.

Career Advancement

Microinsurance product developers harness expertise in risk assessment and customer needs analysis to design affordable insurance solutions for low-income populations. Mastery of data analytics and regulatory compliance accelerates career advancement within insurance firms and opens opportunities in fintech or international development organizations. Pursuing certifications in actuarial science or project management further enhances prospects for leadership roles and specialized product strategy positions.

Key Terms

Client Segmentation

Microinsurance product developers analyze diverse client segments to tailor coverage options that meet the specific needs of low-income populations. They utilize demographic, behavioral, and socioeconomic data to design affordable, accessible insurance products that enhance risk protection for underserved markets. Effective client segmentation drives targeted marketing strategies and improves product relevance, boosting enrollment and customer retention rates.

Policy Pricing

Microinsurance Product Developers specializing in policy pricing analyze risk data and customer demographics to create affordable insurance products tailored for low-income markets. They employ actuarial models and statistical tools to set premium rates that balance profitability with accessibility and regulatory compliance. Their role involves continuous monitoring of claims experience and market trends to adjust pricing strategies and ensure financial sustainability.

kuljobs.com

kuljobs.com