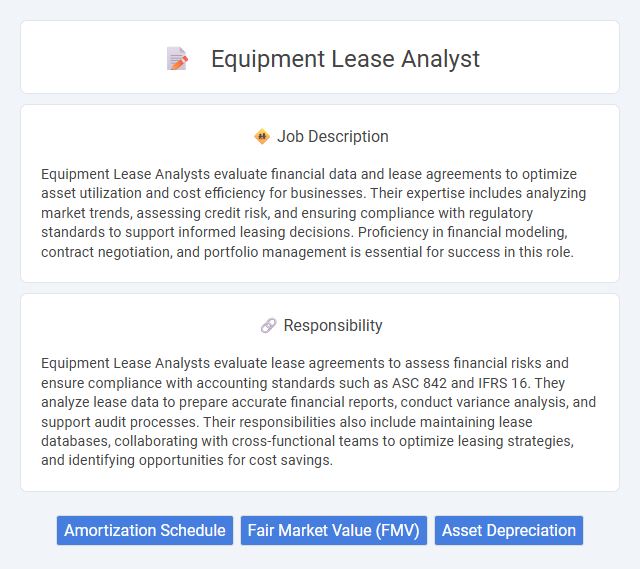

Equipment Lease Analysts evaluate financial data and lease agreements to optimize asset utilization and cost efficiency for businesses. Their expertise includes analyzing market trends, assessing credit risk, and ensuring compliance with regulatory standards to support informed leasing decisions. Proficiency in financial modeling, contract negotiation, and portfolio management is essential for success in this role.

Candidates with strong analytical skills and attention to detail are likely suitable for an Equipment Lease Analyst role, as the position requires careful evaluation of lease agreements and financial data. Individuals who demonstrate proficiency in interpreting contracts and financial reports may perform well, while those lacking these abilities might find the job challenging. A background in finance, accounting, or lease management could increase the probability of success in this role.

Qualification

A successful Equipment Lease Analyst typically holds a bachelor's degree in finance, accounting, or business administration, with strong analytical and quantitative skills essential for evaluating lease agreements and financial statements. Proficiency in lease accounting standards such as ASC 842 and IFRS 16 is crucial, along with expertise in financial modeling and data analysis software like Excel and SQL. Experience in risk assessment, credit analysis, and contract negotiation enhances the ability to optimize leasing strategies and ensure compliance.

Responsibility

Equipment Lease Analysts evaluate lease agreements to assess financial risks and ensure compliance with accounting standards such as ASC 842 and IFRS 16. They analyze lease data to prepare accurate financial reports, conduct variance analysis, and support audit processes. Their responsibilities also include maintaining lease databases, collaborating with cross-functional teams to optimize leasing strategies, and identifying opportunities for cost savings.

Benefit

Equipment Lease Analysts likely enhance financial efficiency by optimizing lease agreements and minimizing costs. They probably contribute to improved risk management through detailed contract analysis and market evaluation. This role may also provide opportunities for career growth and skill development in finance and leasing sectors.

Challenge

The Equipment Lease Analyst role likely involves navigating complex financial data and lease agreements, presenting a consistent challenge in ensuring accuracy and compliance. Managing diverse equipment portfolios could require strong analytical skills to forecast costs and optimize lease terms efficiently. This position may often demand adaptability in response to changing regulatory guidelines and market conditions.

Career Advancement

Equipment Lease Analysts play a crucial role in assessing and managing lease agreements, financial risk, and equipment valuation, providing a strong foundation for advancing into senior finance or asset management roles. Mastery in portfolio analysis and regulatory compliance enhances opportunities to transition into strategic positions such as Lease Portfolio Manager or Finance Director. Proficiency in analytical software and negotiation skills significantly boosts career progression within financial services and corporate leasing sectors.

Key Terms

Amortization Schedule

An Equipment Lease Analyst specializes in managing and analyzing amortization schedules to accurately track lease payments and depreciation over the lease term. They ensure the proper allocation of principal and interest components according to accounting standards such as ASC 842 or IFRS 16. Proficiency in financial modeling and lease portfolio management is essential for optimizing cash flow and maintaining compliance.

Fair Market Value (FMV)

An Equipment Lease Analyst specializes in evaluating Fair Market Value (FMV) to ensure accurate lease structuring and compliance. They analyze asset depreciation, market trends, and residual values to determine FMV, optimizing lease terms and minimizing financial risks. Proficiency in financial modeling and understanding industry benchmarks is essential to provide precise FMV assessments for equipment leasing decisions.

Asset Depreciation

An Equipment Lease Analyst evaluates asset depreciation schedules to optimize lease terms and financial reporting accuracy. They analyze the impact of depreciation on asset value, ensuring compliance with accounting standards such as GAAP or IFRS. Proficiency in financial modeling and lease accounting software enhances decision-making related to asset lifecycle and capital budgeting.

kuljobs.com

kuljobs.com