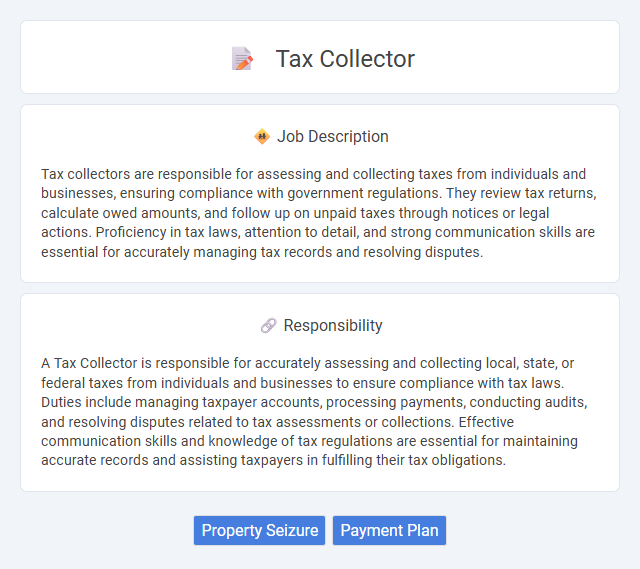

Tax collectors are responsible for assessing and collecting taxes from individuals and businesses, ensuring compliance with government regulations. They review tax returns, calculate owed amounts, and follow up on unpaid taxes through notices or legal actions. Proficiency in tax laws, attention to detail, and strong communication skills are essential for accurately managing tax records and resolving disputes.

Individuals who are comfortable working with numbers and have strong attention to detail are likely to be suitable for a Tax Collector role. It is probable that people who remain calm under pressure and possess good communication skills will handle interactions with taxpayers more effectively. Those who prefer routine tasks and enjoy analyzing financial information may find this job aligns well with their strengths.

Qualification

A Tax Collector must possess strong analytical skills and a thorough understanding of tax laws, regulations, and collection procedures. Proficiency in financial software, attention to detail, and excellent communication abilities are essential to effectively manage taxpayer accounts and resolve disputes. A minimum of a high school diploma is required, though an associate or bachelor's degree in finance, accounting, or public administration significantly enhances job prospects.

Responsibility

A Tax Collector is responsible for accurately assessing and collecting local, state, or federal taxes from individuals and businesses to ensure compliance with tax laws. Duties include managing taxpayer accounts, processing payments, conducting audits, and resolving disputes related to tax assessments or collections. Effective communication skills and knowledge of tax regulations are essential for maintaining accurate records and assisting taxpayers in fulfilling their tax obligations.

Benefit

A Tax Collector job probably offers financial stability through a steady salary and potential bonuses tied to tax revenue collection. It may provide comprehensive benefits such as health insurance, retirement plans, and paid leave that support long-term well-being. Job security and opportunities for career advancement in government agencies might also be expected as key benefits in this role.

Challenge

The role of a tax collector may involve significant challenges due to the complexity of tax laws and the necessity to ensure compliance while maintaining positive taxpayer relations. High-pressure situations could arise from managing disputes and addressing non-compliance, requiring strong negotiation and conflict resolution skills. There is likely a constant need for adaptability as regulations and economic conditions change, potentially affecting collection strategies.

Career Advancement

Tax collectors often begin their careers in entry-level administrative roles, gaining expertise in tax regulations and collection procedures. Progression typically includes positions such as senior tax collector, auditor, or supervisory roles within municipal or state tax departments, leveraging analytical skills and compliance knowledge. Advanced certifications and continued education in taxation laws significantly enhance promotion prospects and salary potential in this field.

Key Terms

Property Seizure

Tax collectors play a critical role in property seizure to recover unpaid taxes, enforcing liens on real estate to satisfy outstanding debts. They coordinate with legal authorities to initiate foreclosure processes and auction seized properties, ensuring compliance with state and local tax laws. Expertise in asset evaluation and legal documentation is essential for efficient property seizure and maximizing tax revenue collection.

Payment Plan

A Tax Collector manages the administration and enforcement of tax payment collections, specializing in the negotiation and establishment of payment plans for taxpayers facing financial difficulties. Payment plans allow taxpayers to settle their tax debts over a specified period, reducing immediate financial burdens while ensuring steady revenue inflow for the government. Effective management of these plans requires thorough knowledge of tax laws, strong communication skills, and the ability to assess individual financial situations to customize resolutions.

kuljobs.com

kuljobs.com