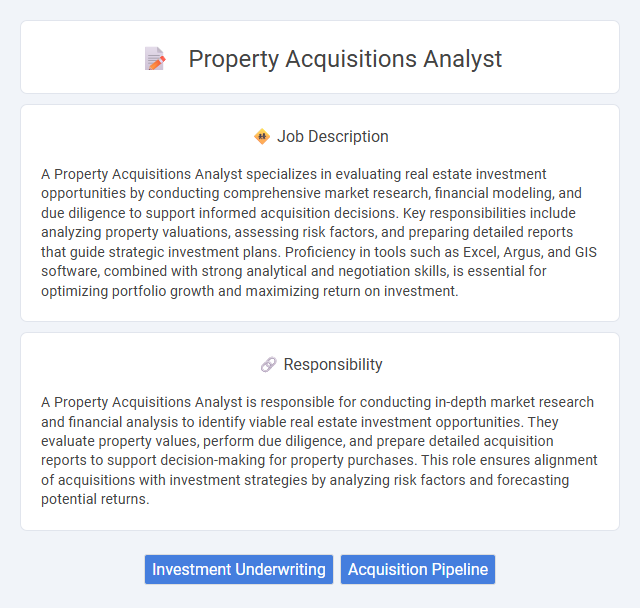

A Property Acquisitions Analyst specializes in evaluating real estate investment opportunities by conducting comprehensive market research, financial modeling, and due diligence to support informed acquisition decisions. Key responsibilities include analyzing property valuations, assessing risk factors, and preparing detailed reports that guide strategic investment plans. Proficiency in tools such as Excel, Argus, and GIS software, combined with strong analytical and negotiation skills, is essential for optimizing portfolio growth and maximizing return on investment.

Individuals with strong analytical skills and attention to detail are likely suitable for a Property Acquisitions Analyst role. Those who thrive in fast-paced environments and have the ability to interpret market trends and financial data may find this job fitting. Candidates lacking critical thinking or effective communication skills might struggle to meet the demands of this position.

Qualification

A Property Acquisitions Analyst typically holds a bachelor's degree in finance, real estate, business administration, or a related field, with strong analytical and financial modeling skills. Proficiency in market research, due diligence, and investment analysis software like Argus or Excel is essential for evaluating property acquisition opportunities. Experience in real estate transactions, understanding of market trends, and excellent negotiation and communication abilities are critical qualifications for this role.

Responsibility

A Property Acquisitions Analyst is responsible for conducting in-depth market research and financial analysis to identify viable real estate investment opportunities. They evaluate property values, perform due diligence, and prepare detailed acquisition reports to support decision-making for property purchases. This role ensures alignment of acquisitions with investment strategies by analyzing risk factors and forecasting potential returns.

Benefit

A Property Acquisitions Analyst likely provides significant benefits by identifying and evaluating potential real estate investments that can maximize profitability and minimize risk. Their analysis may increase the probability of securing high-value properties at optimal prices, contributing to a stronger investment portfolio. Efficient market research and financial modeling performed by these analysts probably support informed decision-making for stakeholders.

Challenge

Property Acquisitions Analyst roles likely involve navigating complex market data and financial models to identify profitable investment opportunities. The challenge often centers on accurately forecasting property values and assessing risk in fluctuating real estate markets. Success in this position probably depends on a keen analytical mindset and the ability to adapt quickly to changing economic conditions.

Career Advancement

Property Acquisitions Analysts play a crucial role in evaluating real estate investment opportunities by conducting comprehensive market research and financial analysis. Mastery of advanced data modeling and negotiation skills significantly enhances prospects for progression into senior analyst or acquisitions manager roles. Consistent performance and expertise in deal structuring often lead to leadership positions within real estate development and asset management firms.

Key Terms

Investment Underwriting

A Property Acquisitions Analyst specializing in Investment Underwriting evaluates real estate assets to determine financial viability, analyzing market trends, cash flow projections, and risk factors to support informed acquisition decisions. Proficiency in financial modeling, due diligence, and capital budgeting is essential for assessing property values and negotiating purchase terms. Expertise in investment underwriting ensures the optimization of portfolio growth by identifying high-return opportunities and mitigating potential losses.

Acquisition Pipeline

A Property Acquisitions Analyst manages and evaluates the acquisition pipeline by conducting detailed financial modeling, market research, and risk assessments to identify high-potential real estate investments. They track deal flow, analyze property performance metrics, and coordinate with acquisition teams to ensure alignment with investment strategies. Expertise in data analytics and CRM tools is essential for optimizing the acquisition pipeline and supporting informed decision-making in property acquisitions.

kuljobs.com

kuljobs.com