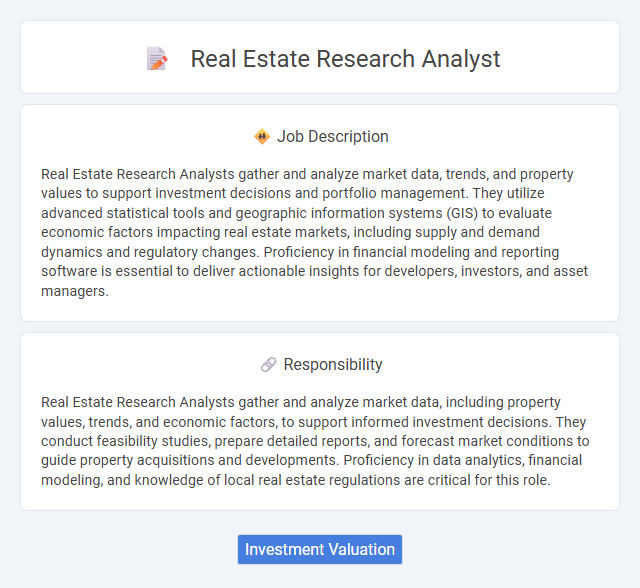

Real Estate Research Analysts gather and analyze market data, trends, and property values to support investment decisions and portfolio management. They utilize advanced statistical tools and geographic information systems (GIS) to evaluate economic factors impacting real estate markets, including supply and demand dynamics and regulatory changes. Proficiency in financial modeling and reporting software is essential to deliver actionable insights for developers, investors, and asset managers.

Individuals with strong analytical skills and a keen interest in market trends will likely be well-suited for a Real Estate Research Analyst position, as the role demands detailed data interpretation and forecasting. Those who prefer structured, data-driven environments over creative or people-focused tasks may find this job more compatible with their strengths. Candidates who are comfortable working independently and handling complex research projects could have a higher probability of success in this field.

Qualification

A Real Estate Research Analyst typically requires a bachelor's degree in finance, economics, real estate, or a related field, with strong analytical and quantitative skills. Proficiency in data analysis software such as Excel, SQL, and real estate databases like CoStar or REIS is essential. Experience in market research, financial modeling, and understanding of property valuation principles strengthens qualification for this role.

Responsibility

Real Estate Research Analysts gather and analyze market data, including property values, trends, and economic factors, to support informed investment decisions. They conduct feasibility studies, prepare detailed reports, and forecast market conditions to guide property acquisitions and developments. Proficiency in data analytics, financial modeling, and knowledge of local real estate regulations are critical for this role.

Benefit

A Real Estate Research Analyst likely benefits from gaining deep market insights that enhance strategic decision-making. This role probably offers opportunities for professional growth through exposure to diverse property types and economic trends. Access to advanced analytical tools and data can also improve accuracy in forecasting property values and investment potential.

Challenge

A Real Estate Research Analyst likely encounters the challenge of interpreting fluctuating market data to provide accurate investment insights. Navigating unpredictable economic trends and regional variations may complicate forecasting property values and demand. This role probably requires strong analytical skills to manage large datasets and derive meaningful conclusions under uncertain conditions.

Career Advancement

Real Estate Research Analysts play a crucial role in evaluating market trends, property values, and investment opportunities to guide strategic decision-making. Mastery of data analytics, economic modeling, and geographic information systems (GIS) enhances career growth potential, leading to senior research roles or portfolio management positions. Continuous professional development and certifications like CCIM or CFA significantly improve promotion prospects within real estate firms or investment companies.

Key Terms

Investment Valuation

A Real Estate Research Analyst specializing in Investment Valuation conducts comprehensive market analysis to determine property values and investment potential by examining financial models, market trends, and comparable sales data. Expertise in discounted cash flow (DCF) analysis, capitalization rates, and risk assessment drives informed recommendations for portfolio optimization and asset acquisition. Advanced proficiency in data analytics software, real estate databases, and economic forecasting is essential for accurate valuation and strategic investment planning.

kuljobs.com

kuljobs.com