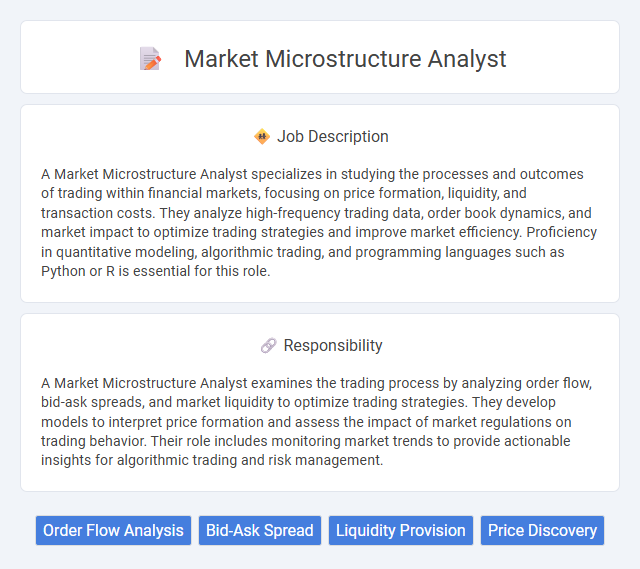

A Market Microstructure Analyst specializes in studying the processes and outcomes of trading within financial markets, focusing on price formation, liquidity, and transaction costs. They analyze high-frequency trading data, order book dynamics, and market impact to optimize trading strategies and improve market efficiency. Proficiency in quantitative modeling, algorithmic trading, and programming languages such as Python or R is essential for this role.

Individuals with strong analytical skills and a passion for financial markets may find a career as a Market Microstructure Analyst well-suited, as the role likely requires deep understanding of trading dynamics and data interpretation. Candidates prone to detail-oriented work and capable of handling high-pressure environments might have a higher probability of thriving in this position. Those less comfortable with complex quantitative analysis or fast-paced decision-making could find the job challenging and potentially less satisfying.

Qualification

A Market Microstructure Analyst requires a strong foundation in quantitative finance, data analysis, and programming languages such as Python, R, or MATLAB. Proficiency in statistical methods, econometrics, and understanding of order book dynamics is essential to interpret trading patterns and market behavior accurately. Advanced degrees in finance, economics, mathematics, or related fields, combined with experience in financial markets, significantly enhance job prospects.

Responsibility

A Market Microstructure Analyst examines the trading process by analyzing order flow, bid-ask spreads, and market liquidity to optimize trading strategies. They develop models to interpret price formation and assess the impact of market regulations on trading behavior. Their role includes monitoring market trends to provide actionable insights for algorithmic trading and risk management.

Benefit

A Market Microstructure Analyst likely benefits from gaining deep insights into the mechanics of trading, which can enhance decision-making accuracy and improve trading strategies' effectiveness. There is a strong probability that this role offers exposure to advanced analytical tools and financial technologies, fostering valuable technical skills. It may also provide opportunities for collaboration with traders and portfolio managers, potentially leading to career advancement within financial markets.

Challenge

Market microstructure analyst roles likely involve navigating complex datasets and interpreting intricate financial behaviors, which can pose significant analytical challenges. The demand for precision and real-time decision-making might increase the pressure to stay updated with evolving market regulations and trading technologies. Adapting to fast-paced environments and managing uncertainty could be ongoing hurdles for professionals in this field.

Career Advancement

Market microstructure analysts specialize in evaluating the trading processes and market dynamics to optimize transaction efficiency and pricing strategies. Career advancement often involves gaining expertise in quantitative analysis, developing proficiency with advanced trading algorithms, and mastering regulatory compliance frameworks. Progression can lead to senior analyst roles, portfolio management, or strategic consulting positions within financial institutions.

Key Terms

Order Flow Analysis

Market microstructure analysts specializing in order flow analysis scrutinize real-time trade and quote data to understand price formation and liquidity dynamics within financial markets. They utilize advanced algorithms and statistical models to interpret order book imbalances, trade execution patterns, and volume distribution, enabling the prediction of short-term price movements and optimal trade timing. Their insights support trading strategies, risk management, and market efficiency improvements by decoding the complex interactions between buyers and sellers.

Bid-Ask Spread

A Market Microstructure Analyst specializes in examining the Bid-Ask Spread to assess liquidity and price efficiency within financial markets. By analyzing real-time trading data and order book dynamics, they identify patterns that impact transaction costs and market depth. Their insights help optimize trading strategies and improve market transparency for institutional investors.

Liquidity Provision

Market microstructure analysts specializing in liquidity provision evaluate the mechanisms that facilitate asset trading and optimize bid-ask spreads to enhance market efficiency. They analyze order book dynamics, transaction costs, and trade execution quality to identify liquidity gaps and improve market depth. By leveraging quantitative models and real-time data, these analysts support strategies that stabilize price formation and reduce market impact for institutional investors.

Price Discovery

Market microstructure analysts specialize in understanding the mechanisms behind price discovery by examining order flows, bid-ask spreads, and trading volumes in financial markets. Their analysis helps identify how information asymmetry and liquidity impact asset pricing and market efficiency. Using advanced quantitative models, these experts provide insights that optimize trading strategies and improve market transparency.

kuljobs.com

kuljobs.com