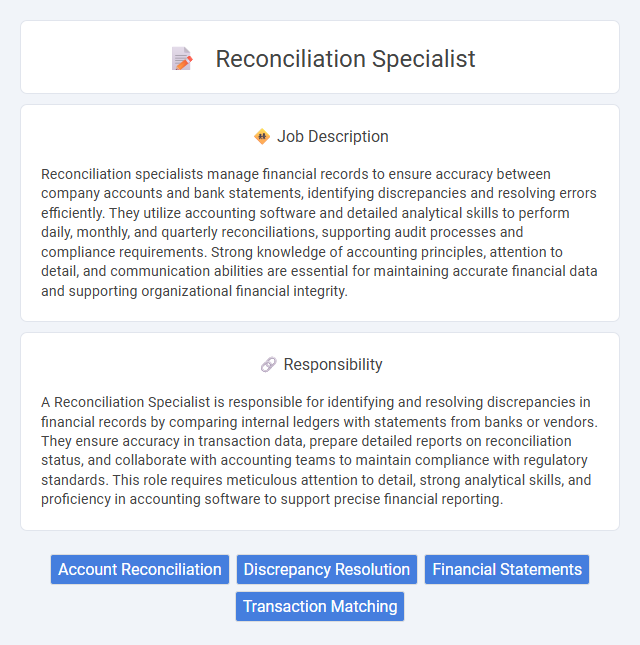

Reconciliation specialists manage financial records to ensure accuracy between company accounts and bank statements, identifying discrepancies and resolving errors efficiently. They utilize accounting software and detailed analytical skills to perform daily, monthly, and quarterly reconciliations, supporting audit processes and compliance requirements. Strong knowledge of accounting principles, attention to detail, and communication abilities are essential for maintaining accurate financial data and supporting organizational financial integrity.

Individuals with strong analytical skills and attention to detail are likely suitable for a reconciliation specialist role, as the job involves verifying financial records and resolving discrepancies. Those who thrive in structured environments and can manage repetitive tasks with accuracy may find this position well-suited to their abilities. However, candidates who struggle with meticulous data review or prefer more dynamic, less routine work may find the role challenging.

Qualification

A Reconciliation Specialist typically requires a bachelor's degree in accounting, finance, or a related field to excel in tracking and resolving discrepancies in financial records. Proficiency in accounting software such as QuickBooks, SAP, or Oracle, along with strong analytical and problem-solving skills, is essential for accurate financial reporting and compliance. Experience in bank statement reconciliation, ledger verification, and maintaining audit trails enhances qualifications for this role.

Responsibility

A Reconciliation Specialist is responsible for identifying and resolving discrepancies in financial records by comparing internal ledgers with statements from banks or vendors. They ensure accuracy in transaction data, prepare detailed reports on reconciliation status, and collaborate with accounting teams to maintain compliance with regulatory standards. This role requires meticulous attention to detail, strong analytical skills, and proficiency in accounting software to support precise financial reporting.

Benefit

A reconciliation specialist likely enhances financial accuracy by systematically comparing transaction records to identify discrepancies, reducing the risk of errors and fraud. This role probably streamlines accounting processes, saving time and resources for the organization. Employers may experience improved regulatory compliance and stronger financial reporting as a result of these efforts.

Challenge

Reconciliation specialists may frequently encounter the challenge of identifying discrepancies in complex financial records, requiring meticulous attention to detail and strong analytical skills. There is a probability that they must navigate tight deadlines while maintaining accuracy, increasing the pressure of their role. Managing and resolving inconsistencies across multiple data sources can pose a significant challenge in ensuring financial integrity.

Career Advancement

Reconciliation specialists enhance financial accuracy by verifying account records, which builds foundational expertise essential for progressing to senior accounting or auditing roles. Mastery in analyzing discrepancies and implementing corrective actions increases eligibility for management positions in finance and risk management. Advanced skills in reconciliation software and regulatory compliance further boost career trajectories toward strategic financial leadership roles.

Key Terms

Account Reconciliation

Account Reconciliation specialists ensure accuracy and consistency by reviewing and comparing financial statements, ledgers, and transaction records to identify discrepancies or errors. Their expertise in analyzing account balances helps detect and resolve variances, contributing to accurate financial reporting and regulatory compliance. Proficiency in reconciliation software and strong attention to detail are essential for maintaining integrity in company financial records.

Discrepancy Resolution

Reconciliation specialists play a critical role in discrepancy resolution by thoroughly analyzing and matching financial records to identify inconsistencies. They utilize advanced software tools and data verification techniques to trace and resolve mismatches between accounts, ensuring accurate financial reporting. Expertise in investigating transaction errors, bank statement variances, and invoice discrepancies enables reconciliation specialists to maintain integrity in financial data and prevent potential compliance issues.

Financial Statements

A Reconciliation Specialist ensures the accuracy and consistency of financial statements by comparing internal records with external documents, such as bank statements and ledgers. They identify discrepancies, investigate variances, and provide detailed reports that support audit readiness and compliance with accounting standards. Proficiency in accounting software, attention to detail, and strong analytical skills are essential for maintaining accurate financial data and supporting organizational financial integrity.

Transaction Matching

A Reconciliation Specialist in Transaction Matching ensures accuracy by comparing and verifying financial records against transaction data from multiple sources, reducing discrepancies and mitigating risks of errors or fraud. Proficiency with accounting software such as SAP, Oracle, or QuickBooks enhances efficiency in matching invoices, payments, and ledger entries. Strong analytical skills combined with attention to detail support timely resolution of mismatches, improving overall financial integrity.

kuljobs.com

kuljobs.com