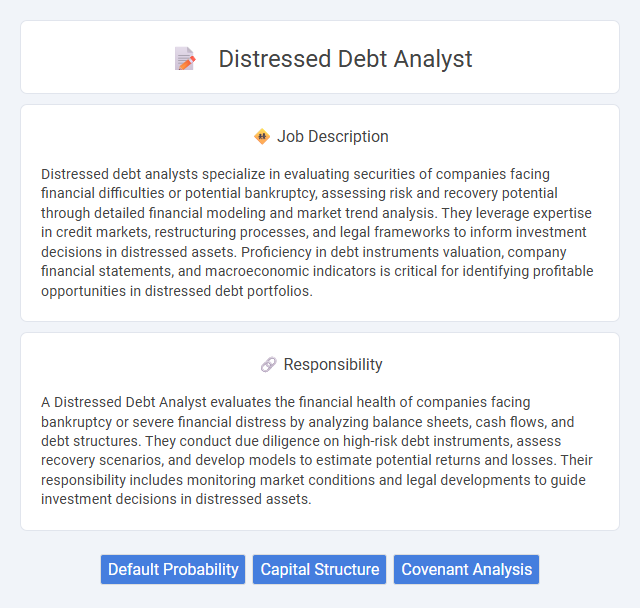

Distressed debt analysts specialize in evaluating securities of companies facing financial difficulties or potential bankruptcy, assessing risk and recovery potential through detailed financial modeling and market trend analysis. They leverage expertise in credit markets, restructuring processes, and legal frameworks to inform investment decisions in distressed assets. Proficiency in debt instruments valuation, company financial statements, and macroeconomic indicators is critical for identifying profitable opportunities in distressed debt portfolios.

Individuals with strong analytical skills and resilience may be well-suited for a distressed debt analyst role, as it often involves evaluating financially troubled companies and navigating complex market conditions. People who thrive under pressure and possess a keen eye for detail are likely to succeed in this high-stakes environment. Those lacking patience or a tolerance for financial uncertainty might find this job less compatible with their strengths.

Qualification

A distressed debt analyst requires strong financial modeling skills, expertise in credit risk analysis, and proficiency in evaluating bankruptcy and restructuring scenarios. Advanced knowledge of accounting principles and experience with distressed securities markets enhance the ability to assess undervalued assets. A background in finance, economics, or related fields, combined with certifications such as CFA or CPA, is highly valued in this role.

Responsibility

A Distressed Debt Analyst evaluates the financial health of companies facing bankruptcy or severe financial distress by analyzing balance sheets, cash flows, and debt structures. They conduct due diligence on high-risk debt instruments, assess recovery scenarios, and develop models to estimate potential returns and losses. Their responsibility includes monitoring market conditions and legal developments to guide investment decisions in distressed assets.

Benefit

A career as a distressed debt analyst likely provides excellent opportunities for financial growth due to the high demand for expertise in managing troubled assets. Professionals in this field probably gain valuable skills in risk assessment and restructuring strategies, which are beneficial for advancing within the finance industry. Exposure to complex market situations may also enhance problem-solving abilities and increase long-term career prospects.

Challenge

A Distressed Debt Analyst likely faces the challenge of accurately assessing the value and risk of financially troubled companies with limited and often incomplete information. Analyzing complex bankruptcy scenarios and predicting potential recovery outcomes probably requires strong analytical skills and deep industry knowledge. The role may involve high pressure to make critical investment recommendations amid market volatility and economic uncertainty.

Career Advancement

Distressed debt analysts specialize in identifying and evaluating underperforming or defaulted securities, providing critical insights for investment decisions and risk management. Mastery of financial modeling, credit analysis, and restructuring strategies significantly enhances promotion prospects to senior analyst, portfolio manager, or hedge fund roles. Continuous skill development and networking within finance sectors accelerate career growth and leadership opportunities in distressed asset management.

Key Terms

Default Probability

A Distressed Debt Analyst specializes in evaluating securities from companies facing financial distress, focusing on default probability to assess investment risks and potential recoveries. This role requires deep analysis of credit ratings, cash flow projections, and macroeconomic factors to estimate the likelihood of a borrower failing to meet debt obligations. Accurate default probability assessment drives strategic decisions in restructuring, trading, and portfolio management within high-risk debt markets.

Capital Structure

A distressed debt analyst specializes in evaluating the capital structure of financially troubled companies to identify investment opportunities in non-performing or underperforming debt instruments. Their expertise involves assessing the hierarchy of claims, including senior secured debt, subordinated loans, and equity, to determine potential recovery rates and risks associated with debt restructuring or bankruptcy scenarios. Proficient knowledge of leverage ratios, covenant terms, and market conditions enables accurate valuation of distressed securities and informs strategic decision-making for distressed asset acquisition.

Covenant Analysis

Distressed debt analysts specialize in evaluating non-performing or underperforming debt securities, with a critical focus on covenant analysis to assess the issuer's compliance with loan agreement terms. Thorough covenant analysis involves scrutinizing financial maintenance ratios, restrictions on additional indebtedness, and asset sale limitations to identify potential default triggers and recovery prospects. This role requires expertise in legal frameworks and financial modeling to effectively forecast risk and value in distressed debt portfolios.

kuljobs.com

kuljobs.com